Knowledge Prefab Homes

Prefab residential property, quick to possess prefabricated house, are houses which might be are manufactured off-webpages then transported on the final place to feel make. These house are created within the managed warehouse surroundings, which could make them less to build than simply antique residential property. Prefab home ranges popular out-of modern in order to old-fashioned and is tailored to complement brand new homeowner’s preferencesmon particular prefab homes is standard residential property, are produced homes, and you will lightweight homes. Prefab residential property are going to be Solitary Relatives Home , Accessory Dwelling Systems or Multi-Family Land. Yet another system MHAdvantage aka CrossMods Property provide the home owner the price discounts away from prefab land but qualifies towards appraised cherished away from web site dependent home.

Benefits associated with Prefab House

Prefab residential property are typically much more cost-productive than old-fashioned home due to the sleek framework techniques. At the same time, they are often times-efficient, which can bring about straight down power bills over the years. Prefab house is personalized, making it possible for residents so you can tailor its liveable space considering its choices. Also, they are green, as they write reduced waste throughout the framework than the conventional residential property. More over, prefab belongings was faster to build, which means you can relocate fundamentally and begin viewing your own brand new home reduced.

Capital Alternatives for Prefab Residential property

In terms of financing prefab house, you will find several options available to adopt. The most famous an effective way to money a beneficial prefab family within the California are conventional mortgage loans, personal loans, and you may design loans geared to prefab land. Traditional mortgages work very well to possess prefab land you to fulfill fundamental building requirements. Signature loans render fast access so you’re able to financing just in case you get not qualify for old-fashioned mortgage loans. Framework financing specifically made for prefab house offer resource both for our home and its own installation.

Money and you will Home loan Considerations

Whenever resource your own prefab family in the California, consider some other mortgage options. FHA money was popular to have basic-time homebuyers, demanding a minimum down-payment off step three.5%. Virtual assistant financing bring advantageous assets to experts and you will effective-responsibility army team, in addition to no deposit. Conventional funds is another option, usually requiring a down-payment of at least 20%. Lookup more home loan rates and you may loan terms to find the best fit for your debts.

Regulators Recommendations Applications

Regulators guidelines programs within the Ca helps you money your own prefab home. These types of programs aim to build domestic-ownership even more obtainable and reasonable to own Californians. Some of the bodies advice choices tend to be down-payment direction software, first-big date family visitors programs, and you will reasonable-desire financing programs. This type of applications provide money and incentives of these lookin to acquire an effective prefab family.

Credit history and Financial Preparation

Maintaining good credit is vital whenever investment an excellent prefab domestic. Loan providers make use of credit rating to determine your creditworthiness therefore the interest your be eligible for. A top credit history can indicate lower rates of interest, saving you cash in the long term. Before applying for a loan, opinion your credit score for your errors and work on improving your own score when needed. Begin by using expenses on time, keeping bank card balances reasonable, and you will to avoid starting the borrowing from the bank account. Monetary preparing pertains to rescuing to have a deposit, insights your budget, and you may assessing your current financial fitness.

Cost management having a great Prefab Household

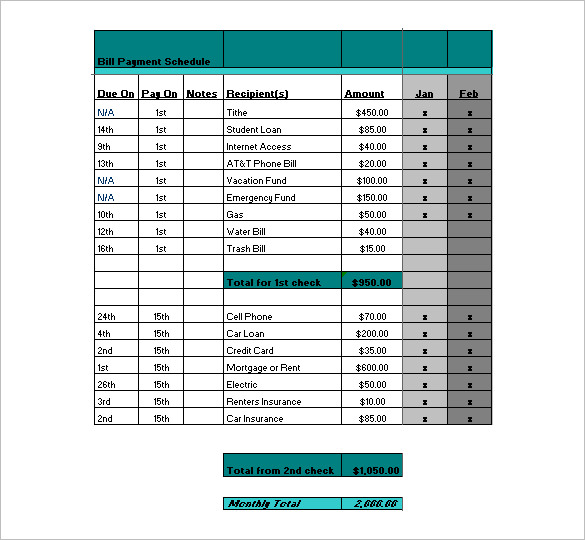

When cost management to possess good prefab domestic from inside the Ca, it is very important consider various can cost you like the actual cost of the prefab domestic, one belongings will cost you, birth and you can set up charge, basis will cost you, it permits, power contacts, and you may any extra modification you can also add. To be sure your stand within this funds, it’s recommended discover estimates away from numerous prefab home people, cause of any potential updates or customization’s, and you may cautiously review the new conditions and terms for all the undetectable will cost you otherwise fees which can happen. Think and you may evaluating thoroughly will allow you to would a sensible funds to suit your prefab home endeavor and steer clear of people monetary surprises together ways.

Looking Loan providers and you may Financing Assessment

When searching for lenders to finance your prefab house, start with evaluating regional borrowing from the bank unions, financial institutions, and online lenders one concentrate on lenders. Its essential to compare rates, financing conditions, and you can fees of additional lenders for the best price. Consider these information when comparing finance:

- Rates of interest: Discover a minimal interest rates available to save money over living of your mortgage.

- Financing Terminology: Pay attention to the amount of the mortgage and you will if this now offers self-reliance for the repayment selection.

- Fees: Look for one origination fees, settlement costs, otherwise prepayment punishment that could increase the price of the fresh new mortgage.

By the contrasting loan providers and you will mortgage choices, you are able to a knowledgeable choice that suits debt demands helping you secure financing for your prefab household in Ca.

Legal aspects and you will Agreements

When you’re dealing with legal aspects and you can contracts to suit your prefab house in Ca, there are a few secret what you should recall. Make sure to carefully realize and you will learn all contracts before you sign them. Find legal services when needed to ensure you might be secure. Here’s a few $5k loans Towaoc from points to consider:

- Ca has actually particular laws and regulations ruling prefab house, thus learn these laws and regulations.

- Understand the guarantee details available with the producer and you may creator so you can prevent one surprises subsequently.

Strategies for Efficiently Financing Your own Prefab Household

Whenever resource your own prefab family, its required to maintain a good credit score. Loan providers have a tendency to check your credit score to choose the loan eligibility. Prioritize rescuing having a down-payment in order to safer a beneficial financing terms. Check around to have lenders examine interest levels and loan choice. Imagine bringing pre-acknowledged for a loan to demonstrate vendors you are a significant client. Build relationships an agent who’s experience in prefab property to simply help navigate brand new to find techniques efficiently.