When it comes to trading in the financial markets, choosing the right broker is paramount to success. One such broker that has made a name for itself in the industry is the Regulated Exness Broker Exness broker. With a range of services tailored to the needs of both novice and experienced traders, Exness stands out as a regulated broker that emphasizes transparency and reliability. In this article, we will explore the various aspects that make Regulated Exness Broker a preferred choice for traders worldwide.

Understanding Regulation

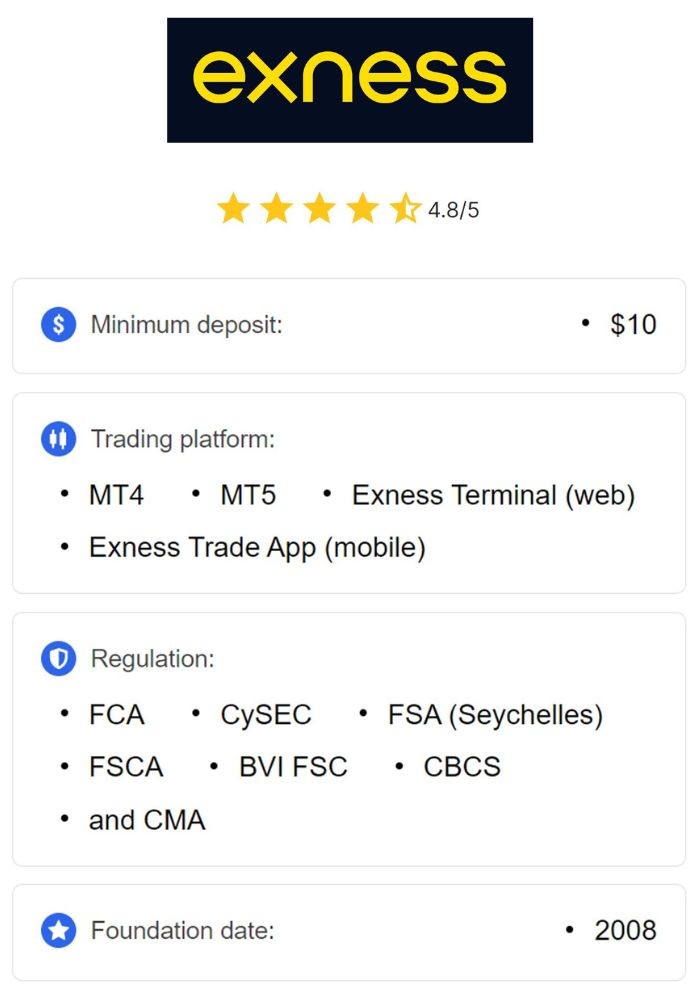

Regulation in the brokerage world refers to the oversight provided by financial authorities to ensure that brokers operate fairly and honestly. This is crucial for protecting traders’ funds and ensuring market integrity. Exness is regulated by various financial authorities including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa.

Being a regulated broker means that Exness adheres to strict standards set forth by these regulatory bodies, ensuring a level of safety and security for traders. Regulations require brokers to maintain certain capital reserves, conduct transactions transparently, and provide traders with a fair trading environment.

Account Types to Suit Every Trader

Exness understands that every trader has different needs and preferences. That’s why they offer a variety of account types to choose from. They provide options such as Standard, Pro, and Cent accounts. Each of these account types caters to different trading strategies and experience levels.

- Standard Account: Ideal for beginner traders looking to start trading with a user-friendly interface and competitive spreads.

- Pro Account: Designed for more experienced traders, offering tighter spreads and higher leverage options to optimize trading performance.

- Cent Account: Perfect for those who want to trade in smaller amounts, allowing users to trade with minimal risk.

Trading Platforms

For any successful trading strategy, it is essential to have access to a reliable trading platform. Exness offers several platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized in the industry and provide advanced trading tools, technical analysis, and automated trading capabilities.

MT4 is particularly popular among forex traders due to its user-friendly interface and extensive charting tools. Meanwhile, MT5 extends beyond forex trading by providing access to a broader range of financial instruments, like stocks and cryptocurrencies. Both platforms are available on desktop and mobile devices, empowering traders to manage their investments anytime, anywhere.

Competitive Spreads and Commissions

Cost is always a factor when it comes to trading. Regulated Exness Broker offers some of the most competitive spreads in the market, ensuring that traders can optimize their trading costs. The broker employs a transparent pricing model, meaning no hidden fees are involved.

For instance, spreads can be as low as 0.0 pips on certain accounts during high liquidity periods, which significantly benefits active traders. Additionally, Exness does not charge commissions on most account types, which enables traders to retain a larger proportion of their profits.

Leverage Options

Leverage is a powerful tool in trading that allows traders to control larger positions with a smaller amount of capital. Exness provides a flexible leverage system, giving traders the ability to select the level of leverage that aligns with their risk tolerance and trading strategy. Leverage can reach up to 1:2000, depending on the account type and trading conditions.

While high leverage can enhance potential profits, it’s important for traders to exercise caution. Using leverage wisely can lead to significant returns, but it also magnifies potential losses. Therefore, understanding how to manage risk while utilizing leverage is crucial for success.

Deposit and Withdrawal Processes

Exness boasts an impressive range of deposit and withdrawal options, allowing traders to fund their accounts easily and conveniently. The broker supports various methods, including credit cards, bank transfers, and numerous e-wallets such as Skrill and Neteller.

One of the standout features of Exness is its commitment to fast withdrawals. Clients often report same-day withdrawal processing, which is advantageous for those who prioritize quick access to their funds. Additionally, there are no withdrawal fees for most methods, ensuring that traders keep more of their earnings.

Education and Support

Exness recognizes the importance of education in the trading journey. They offer a wealth of educational resources designed to cater to traders at all levels. From webinars and market analysis to e-books and tutorials, traders can enhance their knowledge and skills effectively.

Furthermore, the broker offers excellent customer support. Traders can reach out via live chat, email, or phone, and support is available 24/7, accommodating global traders. This level of support ensures that queries and issues are resolved promptly, enhancing the overall trading experience.

Conclusion

In conclusion, the Regulated Exness Broker represents a formidable option for traders looking for a trustworthy, versatile, and efficient trading environment. With comprehensive regulatory oversight, diverse account types, and robust trading platforms, Exness provides the tools and resources that traders need to succeed in the competitive trading landscape.

Whether you’re just starting your trading journey or are a seasoned professional, Exness offers features that can meet your needs. By prioritizing safety, low costs, educational support, and excellent customer service, Exness continues to be a go-to broker for traders worldwide.