Thus you decide now could be the proper some time and you happen to be in a position to carry on the adventure of owning the first house. Well-done! You are in to own a vibrant (and fulfilling) drive.

The first purpose would be to help save sufficient money getting a home financing put. While this may appear overwhelming, learning to finances your a week profit could well be excellent habit having whenever you’ll have to create regular mortgage repayments or any other homes will set you back later on.

Remember, you don’t need to do that alone. New BOQ class possess pooled to one another our very own top tricks and tips so you’re able to efficiently help save and you may budget for your own earliest domestic put.

Suggestion step 1: Estimate just how much you need

The very first thing you should do, before you can even initiate preserving and you may cost management, will be to lay a discount goal. To do that you will have to lookup property prices on the need urban area, work out how far you will have to obtain the home that meets your needs following estimate simply how much your aspire to borrow.

Once you build your quote make sure you consider any extra expenditures, charges and you can taxation that you might get on the fresh new link to have. Otherwise, you may find your guess falls lacking that which you really need.

Once you have had one to number nailed off, you might estimate how much your property lender requires while the a home deposit. Generally, banking companies and you will financial institutions will require in initial deposit around 20% of one’s complete mortgage, but this can are different with respect to the bank whenever your have to shell out Lenders Financial Insurance coverage (LMI).

Tip dos: Set yourself a resources

Today you may have lots coming soon. It is the right time to initiate saving Wellington loans to arrive it! And the the initial thing to do is to place your finances.

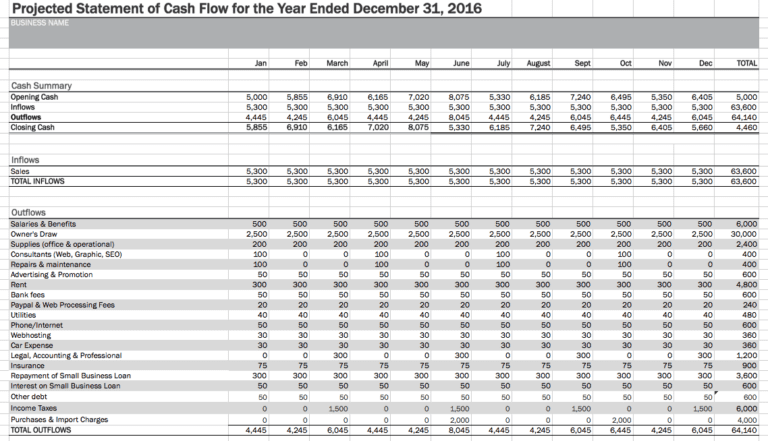

Handling your expenditures can seem to be embarrassing to start with, but when you keep worried about you to definitely end goal of managing your property, the fresh new sacrifices was worth your while. Number your earnings and you can everything spend money on along the span of 1 month (our very own Budget Coordinator helps make this easy for your requirements). Be sure to track the little things you to will most likely not look like an issue otherwise a big costs (in that way 2nd sit down elsewhere otherwise takeaway after work). The little things can add up rapidly.

After you have removed a closer look at the spending patterns, you might select where you could earn some cuts. Do you make your early morning coffees at your home? Might you eradicate a fitness center membership or take right up running?

Suggestion step three: Arrange an automatic transfer

That good way to make sure that your coupons bring priority more than other discretionary using is always to pay it basic. Get a hold of a top-notice savings account or label put and set up an automatic import after every pay day to put and you can forget’.

Idea 4: Control your personal debt

Yours finance, credit cards or any other personal debt would-be costing you a significant amount inside the focus. Consider merging your debt so you’re able to regain control. If you can, make even more repayments to settle the debt ultimately.

Suggestion 5: Think financial help

Discover a range of bodies effort readily available that can assist one to see your first family put sooner or later. Beneath the Basic Home loan Deposit Strategy (FHLDS) such as for instance, Using Lenders makes it possible for around fifteen% away from an initial house client’s mortgage as guaranteed because of the Federal Casing Fund and you can Investment Corporation (NHFIC). Which means you may just need 5% family deposit (and does not must get LMI sometimes).

The original Domestic Super Saver (FHSS) system is an additional effort to take on. It permits you to definitely spend less for the very first home into the your own superannuation loans. The result is that one can save your self easier. Make sure you check your qualifications and also the small print very carefully.

Most other handy a method to spend less

? Lessen every day refreshments instructions by using the own lunch and you may products, or coffee when you look at the good Thermos.

? Hold off into brand new purchases during this preserving several months and you can rather choose for second-hand or keep things to the a desire to checklist.

? Think about your current way of living situation do you really transfer to a more affordable local rental while protecting so you’re able to buy your house?

If you need advice on getting started with another type of house financing, you need to pop to your local BOQ department and you may speak to a financing professionals now? These are typically usually prepared to assist!